This can be difficult to do for new Amazon sellers that are just starting their business, who may be making business purchases with their personal credit card. Amazon sellers will want to avoid mixing their business and personal finances to avoid confusion around tax time or when trying to evaluate profitability. Keep Business and Personal Finances SeparateĪmazon sellers using accounting software will be able to keep data on their business income and expenses separate from their personal finances. TaxCloud lets you visualize your tax report details by jurisdiction. For online retailers, business tax returns require that you supply the COGS.

Once sold, the cost of the product is reduced from the value and applied against the revenue from the sale to determine profit. Having an accurate COGS lets you better manage your inventory, as it will count product inventory as an asset until you sell it. Businesses that sell or manufacture a variety of options will find this process even more involved than others. Accounting software can easily determine your COGS by syncing with your Amazon Seller Central account and downloading all relevant sales data, which eliminates the need to manually match sales to costs.įor many online retailers, calculating the cost of goods sold can be a time-consuming process, as you’ll have to look at all costs involved in producing or buying the products you’ve sold. Many accounting solutions for Amazon sellers will automatically determine your cost of goods sold(COGS), which will let you load your product costs with additional expenses such as procurement costs, production costs, taxes, listing fees, and inventory storage fees. Below are some of the top benefits of accounting programs for Amazon sellers: Manage Cost of Goods Sold for Amazon Sellers

#Bookkeeping software for small business amazon manual

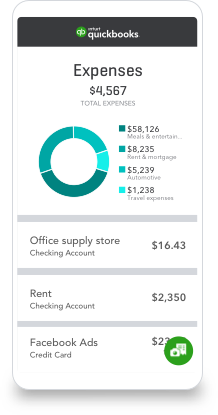

Best Accounting Software for Amazon Sellers BenefitsĪccounting software for Amazon sellers can save eCommerce businesses time and money through quick data entry, speeding up your sale to invoice process, automatic reports, and reducing error through manual methods. The dashboard of Fetcher breaks down sales, units sold, costs, and profit. Track inventory to monitor which items have been sent to, delivered from, or are currently being stored at Amazon’s fulfillment centers. Amazon FBA Sellers Inventory Tracking: Manage your Fulfillment by Amazon (FBA) inventory levels.Helps budget for additional fees due to increased sales and provides for “what-if” analysis. Manage per-item fees, referral costs, variable closing fees, and shipping rates. Sales Tax and Fees Management: Calculates your seller fees based on your selling plan (individual or professional).Decrease the amount of business taxes you have to pay by reducing your tax liability. Cost of Goods Sold (COGS): Match the cost of getting a product to market with the sale of that product to discover revenues, margins, and profitability.Automates the preparation and filing of state tax returns. Sales Tax: Contains a database of all applicable sales tax rates, updated to ensure accuracy, to ensure customers are charged appropriately.Allows for online payment collection and automated notifications through automatic payment reminders and notifications.

Invoicing: Creates invoices for goods sold and sets up recurring billing via credit card payments if applicable.Match the balances in your accounting records with your bank accounts.

Includes bookkeeping modules for accounts payable, accounts receivable, and a general ledger.

0 kommentar(er)

0 kommentar(er)